Irs Schedule D 2024 Form 1 – By law, the IRS must wait until at least mid-February to issue refunds to taxpayers who claimed the earned income tax credit or additional child tax credit. According to the agency, those payments . The Internal Revenue Service (IRS) has recently released the updated Schedule 1 tax form and instructions for the years 2023 and 2024. TRAVERSE CITY, MI, US, January 13, 2024 /EINPresswire.com .

Irs Schedule D 2024 Form 1

Source : www.investopedia.comIRS 1065 Schedule D 1 2011 2024 Fill out Tax Template Online

Source : www.uslegalforms.com2024 Tax Update and What to Expect

Source : sourceadvisors.comForm 1040 for IRS 2024 ~ What is it? Schedule A B C D Instructions

Source : www.incometaxgujarat.orgU.S. Individual Income Tax Return Income

Source : www.irs.gov1040 (2023) | Internal Revenue Service

Source : www.irs.govAll About Schedule A (Form 1040 or 1040 SR): Itemized Deductions

Source : www.investopedia.com1040 (2023) | Internal Revenue Service

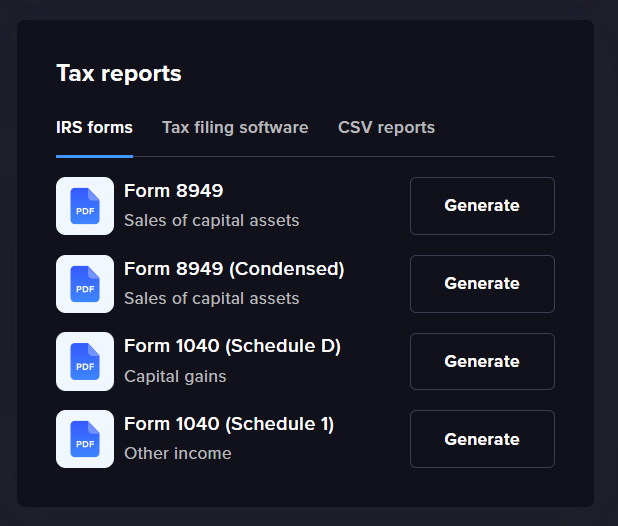

Source : www.irs.govCoinTracker on X: “Tax forms for the 2024 tax season aka the 2023

Source : twitter.comThe Wall Street Journal on LinkedIn: What the 2024 Capital Gains

Source : www.linkedin.comIrs Schedule D 2024 Form 1 What Is Schedule D: Capital Gains and Losses?: The 2024 tax-filing season opens on Jan. 29. Be on the lookout for a W-2 from your employer, as well as various 1099 forms. Some of those opening any CDs in 2024.1. I don’t want to lock . The IRS has started accepting and processing 2023 tax returns from the more than 128.7 million individuals expected to file by the Monday, April 15 deadline. Tax Day, first introduced in .

]]>:max_bytes(150000):strip_icc()/2023ScheduleDForm1040-bce9771cbe94498ab34d6b9107e208de.png)

:max_bytes(150000):strip_icc()/ScheduleA2023-641f841b859949f28b094e61efecc58b.png)